Tax percentage calculator paycheck

Your average tax rate is. Use this tool to.

Biweekly Budget Template Paycheck Budget Budget Printable Etsy Budget Spreadsheet Budgeting Weekly Budget

Learn About Payroll Tax Systems.

. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. And is based on the tax brackets of 2021 and. For annual and hourly wages.

Taxable income Tax rate. Taxable income Tax rate based on filing status Tax liability. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

That means that your net pay will be 40568 per year or 3381 per month. Discover The Answers You Need Here. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

See how your refund take-home pay or tax due are affected by withholding amount. The maximum an employee will pay in 2022 is 911400. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Michigan is a flat-tax state that levies a state income tax of 425. SmartAssets New York paycheck calculator shows your hourly and salary income after federal state and local taxes. Estimate your federal income tax withholding.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. Sign Up Today And Join The Team. Calculate your take home pay after federal Texas taxes deductions and exemptions.

That means that your net pay will be 37957 per year or 3163 per month. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Learn About Payroll Tax Systems.

Enter your info to see your take home pay. A total of 24 Michigan cities charge their own local income taxes on top of the state income tax rate. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Over 900000 Businesses Utilize Our Fast Easy Payroll. All Services Backed by Tax Guarantee. Your average tax rate is.

See where that hard-earned money goes - Federal Income Tax Social Security and. Adjusted gross income - Post-tax deductions Exemptions Taxable income. It can also be used to help fill steps 3 and 4 of a W-4 form.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Updated for 2022 tax year.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It is mainly intended for residents of the US.

Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. Sign Up Today And Join The Team. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

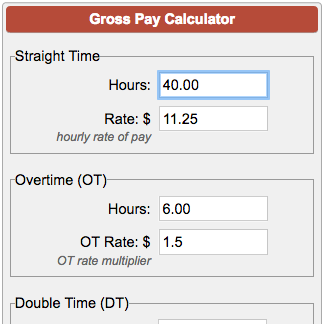

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Calculator For Weekly Pay Hot Sale 50 Off Www Ingeniovirtual Com

Paycheck Calculator Salary Calculator Net Income My Pay Mypercentcalculator

Stubhub Pricing Calculator Pricing Calculator Irs Irs Taxes

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Income Tax Calculator Python Income Tax Income Tax

How To Calculate Payroll Taxes Methods Examples More

Tax Calculator For Weekly Pay Hot Sale 50 Off Www Ingeniovirtual Com

Paycheck Calculator And Salary Calculator Employment Laws Com

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com

What Percentage Of A Paycheck Goes To Taxes Paycheck Tax Tax Services

Aicpa Offers Loan Forgiveness Calculator For Paycheck Protection Program The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Paycheck Calculator Online For Per Pay Period Create W 4

Ready To Use Paycheck Calculator Excel Template Msofficegeek